Host of product firms have moved tech teams here to leverage cost arbitrage in last 8 months

Share

It is not just large banks and IT firms that are tapping into India’s technology talent pool. Over the past year or so, a growing number of small American and European product companies have started moving technology development work to India, as they face a battle for talent competing with large companies in their home markets.

Software as a Service (SaaS) firm Quolum, which started operations earlier this year, has hired three people in India out of its four-member tech team.

“Over the last seven to eight months, we have seen a lot of product companies move tech teams to India to leverage the cost arbitrage. These companies have proven business models and find it easy to attract talent by paying 1.3-1.5 times the prevailing salaries in India,” said Joseph Devasia, MD, Antal India, an executive recruitment firm.

Paying a marginally higher salary is not an issue for foreign firms as it is still one-fifth of what they would have to pay in their home markets. Ridecell, which provides amobility platform for shared vehicles, has a 50-member team in Pune.

“Having a tech office in India gives us the strategic advantage to address the huge market potential in India and the growing mobility markets across Europe, Asia and the Middle East. Additionally, India is the hub for world-class tech talent, so it made complete sense for us to set up a technology office here,” said Samyak Pandya, VP of business operations and finance, Ridecell.

There has been a spike in the number of small tech companies looking at India, said Gaurav Chattur, managing director-Asia Pacific, Catenon Group, a search firm that helps global firms recruit people for their India operations. “The US and European countries are inherently short on tech talent. The visa norms in these countries are also a challenge, which is why even early-stage firms are considering India,” he said.

A recent study by Cornell University found that foreign-born PhD students in the US were more likely to opt to work at a large tech firm over a startup or smaller product firm, simply because of visa issues.

Smaller firms typically do not have the resources to help procure an H-1B visa — essential for a non-US citizen to work in the US. As a result, many of the smaller firms are struggling to find the right talent locally. With large IT services firms also increasing hiring locally in the US, the talent supply pipeline has been choked for product firms.

Very often, these companies have been started by Indians, or have Indians on the core team. In these cases, the choice of where to set up the India operations depends on where the founder has a personal connection.

Switzerland-headquartered Loylogic started out by outsourcing its technology work, but when it decided to move it in-house for IP and knowledge management reasons, India was an obvious choice.

“India (and Pune) has a mature IT industry with access to large resource pool. There is still cost arbitrage compared to European salaries,” said Piyush Khandelwal, Chief Operations Officer, Loylogic Technologies India.

There may be challenges around getting people to work for an unknown entity, but often the lure of doing differentiated work and a higher paycheck are incentives enough.

Share

It is not just large banks and IT firms that are tapping into India’s technology talent pool. Over the past year or so, a growing number of small American and European product companies have started moving technology development work to India, as they face a battle for talent competing with large companies in their home markets.

Software as a Service (SaaS) firm Quolum, which started operations earlier this year, has hired three people in India out of its four-member tech team.

“Over the last seven to eight months, we have seen a lot of product companies move tech teams to India to leverage the cost arbitrage. These companies have proven business models and find it easy to attract talent by paying 1.3-1.5 times the prevailing salaries in India,” said Joseph Devasia, MD, Antal India, an executive recruitment firm.

Paying a marginally higher salary is not an issue for foreign firms as it is still one-fifth of what they would have to pay in their home markets. Ridecell, which provides amobility platform for shared vehicles, has a 50-member team in Pune.

“Having a tech office in India gives us the strategic advantage to address the huge market potential in India and the growing mobility markets across Europe, Asia and the Middle East. Additionally, India is the hub for world-class tech talent, so it made complete sense for us to set up a technology office here,” said Samyak Pandya, VP of business operations and finance, Ridecell.

There has been a spike in the number of small tech companies looking at India, said Gaurav Chattur, managing director-Asia Pacific, Catenon Group, a search firm that helps global firms recruit people for their India operations. “The US and European countries are inherently short on tech talent. The visa norms in these countries are also a challenge, which is why even early-stage firms are considering India,” he said.

A recent study by Cornell University found that foreign-born PhD students in the US were more likely to opt to work at a large tech firm over a startup or smaller product firm, simply because of visa issues.

Smaller firms typically do not have the resources to help procure an H-1B visa — essential for a non-US citizen to work in the US. As a result, many of the smaller firms are struggling to find the right talent locally. With large IT services firms also increasing hiring locally in the US, the talent supply pipeline has been choked for product firms.

Very often, these companies have been started by Indians, or have Indians on the core team. In these cases, the choice of where to set up the India operations depends on where the founder has a personal connection.

Switzerland-headquartered Loylogic started out by outsourcing its technology work, but when it decided to move it in-house for IP and knowledge management reasons, India was an obvious choice.

“India (and Pune) has a mature IT industry with access to large resource pool. There is still cost arbitrage compared to European salaries,” said Piyush Khandelwal, Chief Operations Officer, Loylogic Technologies India.

There may be challenges around getting people to work for an unknown entity, but often the lure of doing differentiated work and a higher paycheck are incentives enough.

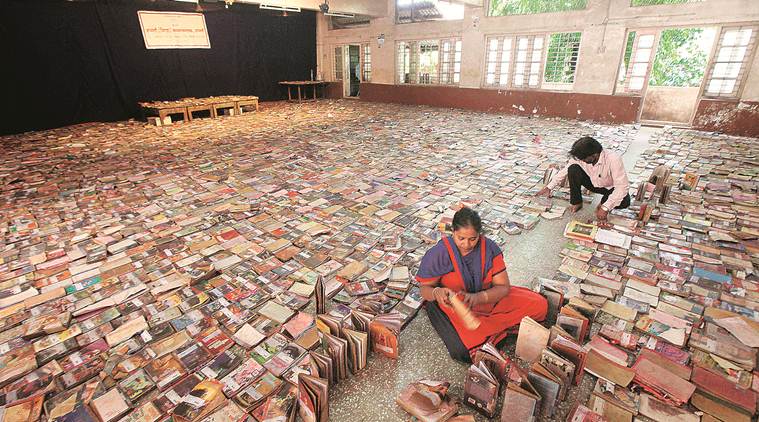

At the Sangli District Nagar Vachnalaya, one of the oldest public libraries. (Express photo by Pavan Khengre)

At the Sangli District Nagar Vachnalaya, one of the oldest public libraries. (Express photo by Pavan Khengre)